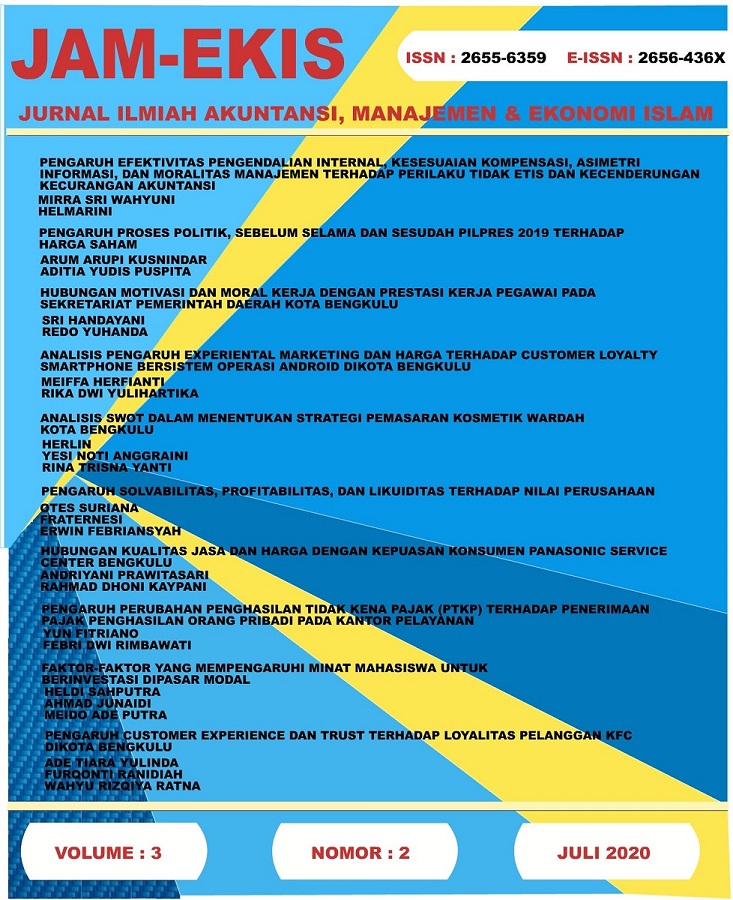

PENGARUH PERUBAHAN PENGHASILAN TIDAK KENA PAJAK (PTKP) TERHADAP PENERIMAAN PAJAK PENGHASILAN ORANG PRIBADI PADA KANTOR PELAYANAN PAJAK PRATAMA ARGAMAKMUR

DOI:

https://doi.org/10.36085/jam-ekis.v3i2.769Abstract

The purpose of this study is to determine the influence of Non-Taxable Income (PTKP) on Personal Income Tax Acceptance at Kantor Pelayanan Pajak Pratama Argamakmur. PTKP is a certain amount of income that is not taxable which can reduce the amount of personal income tax revenue. The method used in this research is to use data collection method of documentation and analysis method used is descriptive quantitative. The analysis in this study uses a simple linear regression formula and coefficient of determination with the help of SPSS application. And to prove the effect of Non-Taxable Income (PTKP) on Personal Income Tax Acceptance then used hypothesis test (t test).

The results of the simple linear regression data data of Y = 9461924484.969 - 1054.200 (X) and data analysis using the determination coefficient is 0.106 with the contribution of the variable non-taxable income (X) to the receipt of personal income tax is 10.6%, while the rest is influenced by other variables not examined in this study. From the results of the data processing, the value of t-count is -2,010 and the value of t-table is 1.305. if the two values are compared, then the t count is -2.010 ≤ t table 1.305 which means that the Non-Taxable Income has a significant negative effect on the Personal Income Tax Revenue.