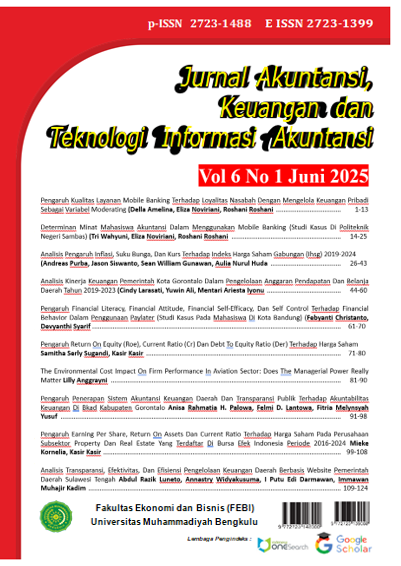

ANALISIS KINERJA KEUANGAN PEMERINTAH KOTA GORONTALO DALAM PENGELOLAAN ANGGARAN PENDAPATAN DAN BELANJA DAERAH TAHUN 2019-2023

DOI:

https://doi.org/10.36085/jakta.v6i1.8306Abstract

This study aims to analyze the financial performance of the Gorontalo City Government in the 2019–2023 period using a mixed methods sequential explanatory model approach. Quantitative data were obtained from the City Budget Realization Report (LRA), balance sheet, and CAKL, analyzed using seven financial ratios: independence, degree of decentralization, dependence, PAD effectiveness, efficiency, spending activity, and PAD growth. The qualitative stage involved semi-structured interviews with informants from the City Finance Agency and taxpayers. The results showed that the average independence ratio was 40.87% (low category), the degree of decentralization was 25.97% (sufficient), financial dependence was 64.29% (very high), and PAD effectiveness was sufficient (94.34%), but efficiency decreased (104.65%) and operating expenses dominated (87.72%) compared to capital expenditures (11.99%). PAD growth fluctuated with a low average (15.35%). Qualitative analysis revealed the main factors: suboptimal financial management, low PAD due to tax and policy awareness, and a small portion of capital expenditure. In conclusion, the financial performance of Gorontalo City is not yet independent and efficient, still highly dependent on central transfers, needs to improve management, increase PAD, and increase the portion of capital expenditure to strengthen fiscal independence and regional development.

Keywords: Financial Performance, Regional Financial, Independence Ratio

References

Soraida, S. (2022). Analisis kinerja keuangan pemerintah daerah Kota Banjarmasin sebelum dan selama pandemi. Jurnal Ekonomi dan Manajemen, 1(2), 78–82. https://doi.org/10.56127/jekma.v1i2.154 a jurnal.umsu.ac.id+13journal.admi.or.id+13reddit.com+13

Katjong, A., et al. (2024). Kebijakan UU No. 1 Tahun 2022 tentang Perimbangan Keuangan antara Pemerintah Pusat dan Daerah. Lex Journal: Kajian Hukum dan Keadilan, 6(1), 121–137. https://doi.org/10.25139/lex.v6i1.4749

Razak, R., et al. (2023). Analisis peran PAD dan Dana Perimbangan dalam belanja modal daerah. Jurnal Inovasi Global, 2(1), 1–15.

Saragih, T., & Siregar, R. (2020). PAD sebagai sumber utama kemandirian keuangan daerah. Jurnal Ekonomi Daerah, 10(2), 155–170.

Siregar, R., & Mariana, D. (2020). Pengawasan kinerja pemerintahan daerah: studi efektivitas PAD. Jurnal Akuntansi Publik, 5(3), 45–60.

Sartika, D. (2019). APBD sebagai alat perencanaan dan pengelolaan pembangunan daerah. Jurnal Keuangan Daerah, 4(1), 25–40.

Halim, I. (2016). Analisis rasio keuangan daerah terhadap laporan keuangan. Jurnal Akuntansi dan Keuangan Publik, 3(2), 112–128.

Nurarifah, Y., et al. (2023). Faktor pengelolaan keuangan daerah terhadap kinerja fiskal. Jurnal Ekonomi dan Studi Publik, 7(1), 77–90.

Tahir, M., et al. (2019). PAD dan Belanja Modal sebagai faktor efektivitas keuangan daerah. Jurnal Manajemen dan Keuangan Daerah, 2(1), 99–114.

Faridah, A., & Rauf, M. (2023). Kota Gorontalo: pusat ekonomi, jasa, dan keagamaan di Indonesia Timur. Jurnal Pembangunan Daerah, 8(2), 201–218. (tidak ditemukan online)

Salisah, N. (2024). Peringkat kemiskinan Kota Gorontalo: analisis status ke-8 secara nasional. Jurnal Publik Indonesia, 12(1), 33–47.

Permata, A., & Riharjo, S. (2019). Dana perimbangan dominan di daerah otonom. Jurnal Pemerintahan Daerah, 6(3), 37–54.

Salim, T., et al. (2025). Peran infrastruktur daerah dalam perekonomian lokal. Jurnal Infrastruktur Indonesia, 1(1), 15–29.

Putra, B. (2018). Kinerja keuangan daerah: keuntungan dan efisiensi penggunaan anggaran. Jurnal Kajian Ekonomi Daerah, 3(2), 50–68.